Dear Esteemed Shareholders,

The Management Discussion and Analysis (“MD&A”) is intended to provide the stakeholder with operational and financial highlights of CCK Consolidated Holdings Berhad (“CCK” or “the Group”) for the financial year ended 31 December 2024 (“FY2024”).

The MD&A should be read together with the audited financial statements of the Group and Company as set out in this Annual Report.

CCK’s business comprises of four (4) segments, namely; retail, poultry, prawn and food service. Business operations are carried out primarily in Sarawak, Sabah and Indonesia (Jakarta, Pontianak and Tarakan). The Group employs a total of approximately 2,986 employees across all business segments.

The Group’s mainstay and core business is the retail segment, which operates retail stores, supermarkets and wholesale stores. Since the opening of the first retail store in Sibu in 1970, CCK’s network has grown to seventy-six (76) touch points comprising of retail stores and supermarkets across East Malaysia (Sarawak and Sabah). Retail stores are operated under the CCK Fresh Mart brand and supermarkets under the CCKLocal brand.

CCK Fresh Mart retail stores cater to both businesses and households, carrying a smaller range of strategically selected stock keeping units (“SKU”) which are specifically targeted to certain locations and buyer demographics. CCK Fresh Mart retail stores are typically smaller format stores located in both urban and rural areas.

CCKLocal supermarkets typically occupy a larger footprint and offer households a wide range of SKUs ranging from local and imported food items to general household items. CCK’s wide-reaching retail network is supported by a fully integrated supply chain consisting of a feedmill, layer farming, poultry farming and processing, prawn farming and processing, and the manufacturing of house-brand food products.

As Sarawak’s largest integrated poultry supplier, CCK’s wide-reaching retail network benefits from being vertically integrated with the poultry segment. Much like the retail network, CCK’s farm operations and processing facilities are also located in Sarawak and Sabah. On a blended basis, fresh dressed chicken and chicken parts make up approximately 15% of CCK Fresh Mart retail stores’ SKU. The other 85% of CCK Fresh Mart retail stores’ products comprise house-brand and third-party frozen products, seafood products, fresh fruits, and vegetables.

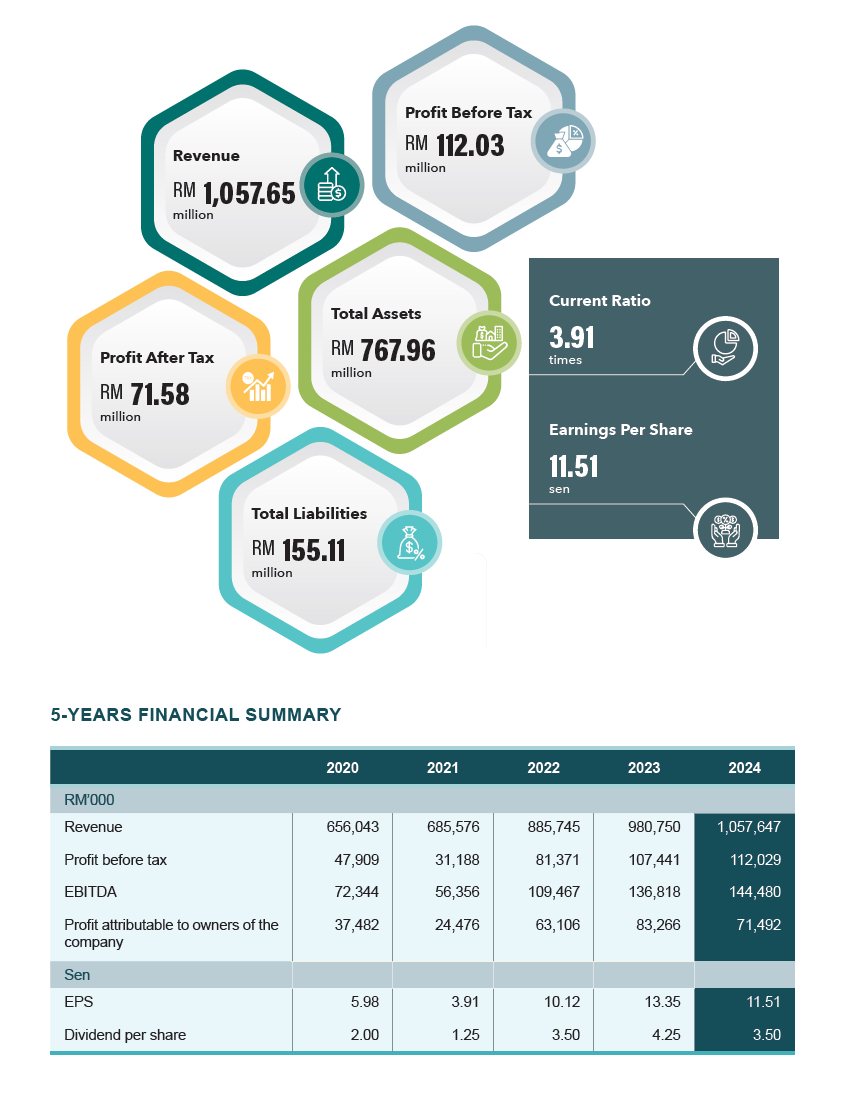

Revenue for FY2024 increased by 7.8% to RM1,057.6 million from a year ago (“FY2023”). Revenue growth was driven by improved performances from the retail and poultry segments. Notably, higher consumer demand led to a better performance in the retail segment whilst higher demand for poultry products from both our institutional clients and our own retail stores (intersegment sales) boosted the poultry segment.

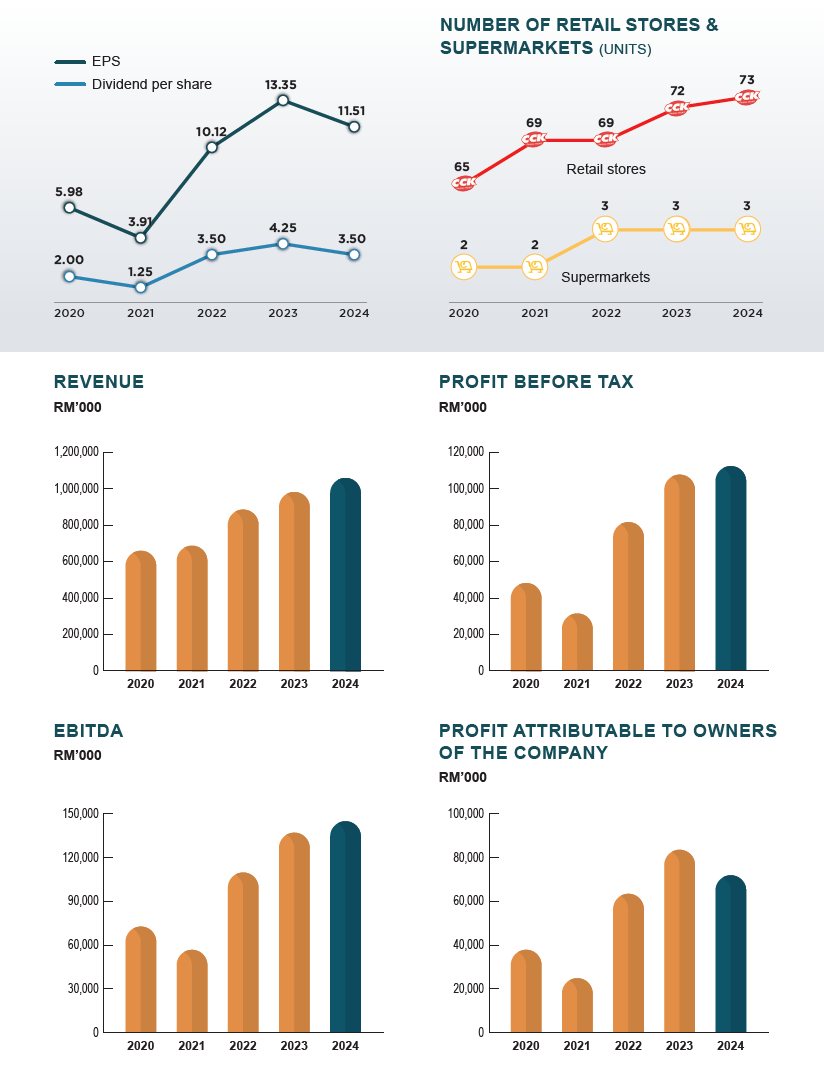

During FY2024, two (2) new CCK Fresh Mart retail stores were opened in Beaufort in Sabah and in Kanowit in Sarawak and one (1) CCK Fresh Mart retail store was closed in Mukah in Sarawak. This brought our retail network to sixty-seven (67) CCK Fresh Mart retail stores, three (3) CCKLocal supermarkets and six (6) wholesale stores. This gives us a total of seventy-six (76) touchpoints, up from seventy-five (75) as at end FY2023.

The retail segment achieved a revenue of RM819.8 million during FY2024, 9.0% higher than FY2023. Growth was driven by more matured contributions from our established retail network, higher sales volumes from both the retail and wholesale channels, and strong demand for our in-house manufactured processed products in Indonesia.

Notably, our Indonesian manufacturing operations was able to cater to the strong demand due to the additional production capacity that came on stream in January 2021. Revenue from our Indonesian manufacturing operations (Pontianak and Jakarta) amounted to RM212.6 million, accounting for 20.0% of total Group revenue for FY2024.

The poultry segment reported a total segment revenue of RM374.9 million for FY2024, an increase of 11.4% from the same period last year. The better performance was mainly driven by an increasing demand for poultry products with sales from both institutional clients and our own retail stores (intersegment sales).

The prawn segment’s revenue amounted to RM91.3 million in FY2024, declined marginally by 2.3% from RM93.5 million in FY2023. The segment’s performance continued to be driven by the contributions from PT Bonanza, which continued to drive overall segment export volumes, particularly to Japan and Taiwan. Sales via our own retail channels also remained stable despite some moderation, contributing positively to overall segment performance.

The food service segment reported revenue of RM20.8 million, declined from RM24.1 million in FY2023. This was mainly due to lower sales volume and demand from the government schools in Sarawak covered under our supply contracts.

The Group recorded a profit before tax (“PBT”) of RM112.0 million for FY2024, increased 4.3% from RM107.4 million in FY2023. Overall profitability was primarily driven by the better performance of the retail segment, while the poultry, prawn and food service segments remained relatively stable despite some moderation. Notably, the poultry segment saw a spike in profitability in FY2023 due to government subsidies related to price ceilings for broilers and eggs, creating a high base effect. Gross profit margins for FY2024 inched up to 21.4% from 20.2% in FY2023.

The retail segment reported a segment PBT of RM80.8 million, a significant improvement of 13.1% compared to the same period last year. Growth was driven by a myriad of factors, including increased sales volumes in our retail and wholesale channels driven by an overall improvement in consumer demand, more favourable product mix and strong demand for our in-house manufactured processed products in Indonesia.

The poultry segment reported a PBT of RM24.7 million, was largely unchanged compared to FY2023. However, operational performance has improved, benefiting from effective cost control measures and a favourable product mix. In contrast, last year’s profitability was boosted by government subsidies related to price ceilings for broilers and eggs.

The prawn segment recorded a PBT of RM9.1 million, declined 4.4% from RM9.5 million in FY2023. Segment profitability affected by a moderation in average selling prices and sales volumes to key export markets during the period under review.

The food service segment reported a PBT of RM1.5 million in FY2024, lower compared to RM3.0 million in FY2023. The decrease in profitability was due to lower sales volume of the segment.

Operating and administrative expenses increased due to the additional running costs incurred by PT Bonanza, facilities in Pontianak, Indonesia, and retail outlets that came on stream in the last few quarters.

Share of results in our associate company, Gold Coin (Sarawak) Sdn Bhd, amounted to RM5.0 million in FY2024, a growth of 4.4% compared to RM4.8 million in FY2023.

Finance costs for FY2024 amounted to RM3.0 million whilst total borrowings stood at RM49.0 million against shareholders’ funds of RM565.4 million as at end-December 2024, translating into a gearing ratio of 0.09 times.

CCK maintained a net cash position as deposits with licensed banks and cash and bank balances surged to RM172.9 million from RM124.6 million as at end-December 2023.

The Group’s property, plant and equipment rose to RM232.2 million as at end-December 2024 from RM216.2 million a year ago. Notable capital expenditure carried out during FY2024 was for the commissioning of two (2) additional CCK Fresh Mart stores, acquisition of a new shoplot in Sibu and addition of motor vehicles for use in Sibu, Kota Kinabalu and Bintulu, as well as new building and equipment for the Black Soldier Fly project, and upgrades to an existing Fresh Mart store in Sibu. All capital expenditure was funded by a combination of bank borrowings and internally generated funds.

In FY2024, we expanded our retail network as follows –

- Two (2) CCK Fresh Mart retail stores; one (1) in Beaufort, Sabah, and one (1) in Kanowit, Sarawak.

Meanwhile, the Group closed one (1) CCK Fresh Mart retail store in Mukah, Sarawak.

To recap, the acquisition of PT Bonanza was completed in July 2022, during FY2022. Established for the past 22 years, PT Bonanza operates out of Tarakan and is engaged in the processing of shrimp for local and export markets. PT Bonanza’s key products are frozen raw shrimp, frozen cooked shrimp and frozen Nobashi Ebi shrimp.

As evidenced by the performance of the prawn segment in FY2024, the acquisition has augmented our seafood business and increased the size and scale of our export-oriented prawn products. Specifically, the prawn segment benefitted from a full year of contribution from PT Bonanza which boosted export volumes to Japan and Taiwan.

Our manufacturing operations in Indonesia continued to benefit from an overall increase in production capacity due to the addition of Pontianak’s facility that was commissioned in January 2021. This additional production capacity supported the higher sales volumes of our own in-house brands of sausages, nuggets and other processed products.

Sausages continue to be the CCK’s best seller in Indonesia whilst the sales of nuggets continue to gain momentum.

All products from our two (2) factories in Jakarta and Pontianak are sold to our network of six (6) locally partnered Freshmart outlets in Pontianak as well as to third parties in Jakarta and Pontianak.

Notably, during FY2024, the Group successfully completed the disposal of 37.7% stake in PT Adilmart to Astrantia in December 2024. We are optimistic that this strategic alignment will add a new dimension to our growth strategies and accelerate our pace of expansion. Beyond unlocking operational efficiencies, Astrantia will also support the expansion of production capacity, the opening of new sales channels, and brand building. With this partnership, we are well-positioned to drive long-term, sustainable growth for PT Adilmart.

CCK practises a policy of dealing with creditworthy customers based on careful evaluation of each credit customer’s financial standing and credit history. This practice mitigates the risk of financial loss from possible default payments. The Group has also in place a credit monitoring process which regularly monitors the status and payments of our credit customers.

The Group imports frozen products for the network of retail stores where the purchases are denominated in US dollars. As such, the Group is exposed to currency fluctuation risk. Any adverse fluctuation in the MYR/USD rate may affect the profitability of the Group. In addition, fluctuations in the MYR/USD will likely affect the cost of feed for the poultry segment.

The Group maintains an adequate level of cash and cash equivalents and banking facilities to ensure sufficient liquidity to meet its liabilities as and when they fall due. The Group’s exposure to liquidity risk arises principally from trade payables, other payables and other bank borrowings (bankers’ acceptances and a revolving credit).

CCK retail stores face increasing risks from existing and new competitors who offer similar products and compete on the basis of pricing. To mitigate this, we are continuously looking at means to improve our competitive edge. The Management not only focuses on pricing of products but also in evolving business models which improve the customers’ shopping experience.

Concerns regarding disease and biosecurity at our chicken farms are constantly high on the agenda. The economic impact of a disease outbreak in any farm can be catastrophic on CCK’s bottom line. Constant monitoring is a compulsory standard operating procedure across all our operations even as we continuously innovate and update our biosecurity measures.

CCK has an internal dividend policy of paying up to 30% of the profit after taxation and minority interests whilst taking into consideration the level of available funds, the amount of retained earnings, capital expenditure commitments and other investment planning requirements.

In line with our commitment to reward shareholders, the Board of Directors declared a special interim single-tier dividend of 5.0 sen per ordinary share in respect of FY2024, duly paid on 22 January 2025.

The Board is pleased to announce a final single-tier dividend of 3.50 sen for the financial year ended 31 December 2024.

Operating in the dynamic and increasingly challenging retail landscape, CCK remains committed to delivering essential everyday staples through our extensive urban and rural network. We cater to diverse consumer needs with a wide range of offerings – including poultry, fresh produce, seafood, and both house-brand and third-party frozen goods. While our key business segments are closely tied to consumer sentiment and demand, the inherent resilience of these staple products reinforces our position in the market.

Employing a vertically integrated business model, this allows us to exert greater control over our supply chain and operations. This integrated approach, coupled with the nature of our product offerings, gives us the ability to be agile whilst developing a commendable resilience to market fluctuations and challenges.

That said, we continue to operate in a high inflationary environment, exerting pressure on costs throughout the supply chain. This inflationary trend compounds the challenges posed by fluctuating currency exchange rates and rising input costs, further straining our cost structures.

Specifically, the volatility of the US dollar against the Malaysian Ringgit remains a concern as it leads to fluctuations in prices of corn and soy. Feed prices constitute a significant portion of the poultry segment’s costs which in-turn make up about 50% of our retail segment’s sales.

Consequently, we actively employ strategies to address these cost pressures, seeking efficiencies wherever possible while remaining mindful of the impact on pricing and profitability.

Our focus remains on mitigating these cost pressures through prudent cost management practices, operational optimisations, and strategic pricing adjustments, ensuring that we maintain our competitiveness in the market.

Strategically expanding our retail network remains integral to our growth trajectory, with a concerted focus on optimising economies of scale and enhancing the efficiency of our fully integrated supply chain. This will bolster our capacity to meet evolving consumer demands while maximising operational efficiencies.

In December 2024, CCK successfully completed the disposal of a stake in PT Adilmart to Astrantia. Having grown our Indonesian manufacturing business at double-digit rates since our venture more than a decade ago, we are excited to welcome Astrantia as a partner as we work hand-in-hand to take this business to the next level. This transaction marks a significant step in enhancing our value-creation potential, as we leverage our partnership with Astrantia to unlock new growth opportunities through combined expertise. Following the first closing date of the transaction (23 December 2024), Astrantia now owns 37.7% of PT Adilmart.

Looking ahead, we are optimistic that this strategic alignment will add a new dimension to our growth strategies and accelerate our pace of expansion. Beyond unlocking operational efficiencies, Astrantia will also support the expansion of production capacity, the opening of new sales channels, and brand building. With this partnership, we are well-positioned to drive long-term, sustainable growth for PT Adilmart.

As we look forward, we remain steadfast in our commitment to proactive risk mitigation and operational optimisation across all key business segments. Whilst we navigate the aforementioned challenges with agility and foresight, we are equally committed to execute our growth plans and strategies.

Taking into account the above, we are therefore cautiously optimistic with regards to the coming financial year.

I want to express my deepest gratitude to the Board of Directors, Management Team, and the incredible staff of CCK. Your dedication, perseverance, and collective commitment have been the driving force behind our success, enabling us to navigate an ever-evolving retail landscape with confidence and resilience.

Your hard work and determination continue to propel CCK forward, ensuring sustained growth and progress. I also extend my sincere gratitude to our valued shareholders, trusted business partners, and stakeholders. Your ongoing support, collaboration, and trust inspire us to push boundaries, innovate, and deliver greater value.

Your unwavering support and confidence inspire us to push boundaries, strive for excellence, and deliver exceptional value and service. Together, we look ahead with optimism, building on our achievements and striving for an even brighter future for CCK.